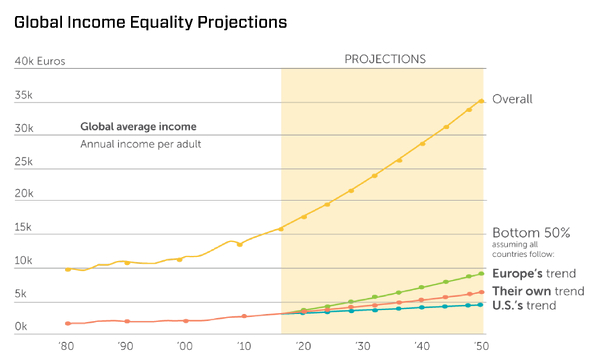

Healthcare is such a significant part of the economy that we can forget we are ultimately downstream of larger global and national trends. One of the biggest trends is the global pressures on the middle class.While US income inequality has been hotly discussed of late, the global trends tell the same story. Income inequality has been on a 40-year charge (see chart 1 below). Regardless of how stakeholders feel about this pattern, it’s malpractice not to plan for its possible continuation.

If current trend lines hold, what will this trend mean for healthcare, especially for hospitals and health systems?

#1 – Figure out where you fit.

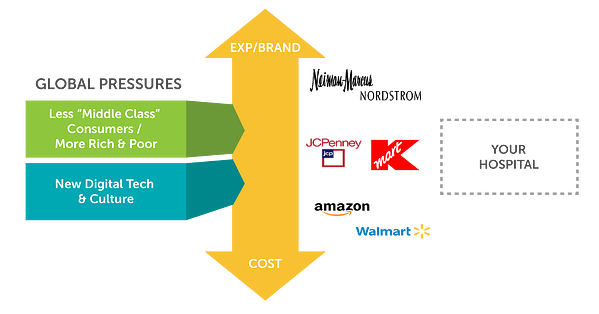

Economic inequality, combined with the advance of online shopping, has already rippled throughout the retail industry. While there are fewer physical stores in some markets then there used to be, the more meaningful change is what kinds of stores remain. Now the retail market is very bifurcated for the consumers they serve. On one hand are the high end, deeply personal shopping experiences (e.g., Nordstrom, Neiman Marcus), and on the other hand are tech-enabled and very efficient venues like Amazon and Walmart. (see graphic 2).

To navigate this tough issue, you need to figure out what kind of market you are in. Is it a growing, wealthy metro region which can support a wide range of service providers who offer expensive and highly customized services? Or is your market dominated by people who will be economically strained and really need the best value for each dollar? Could you change the markets where you compete to tackle the challenge that best fits your organization (though virtual medicine, for example)? Retailers who struggled to define their space tended to struggle through major industry disruption as well.

#2 – Value may require a radically different health care experience

While the appetite for owning lives (capitation) has faded in some health systems and some value-based care policies are not being as strongly advocated by the federal government, it doesn’t mean the fundamentals have changed. Healthcare costs have marched upwards, and for most individuals, it is becoming increasingly unaffordable. Moving to value is the only way to avoid having a Faustian bargain over who does and doesn’t get what care.

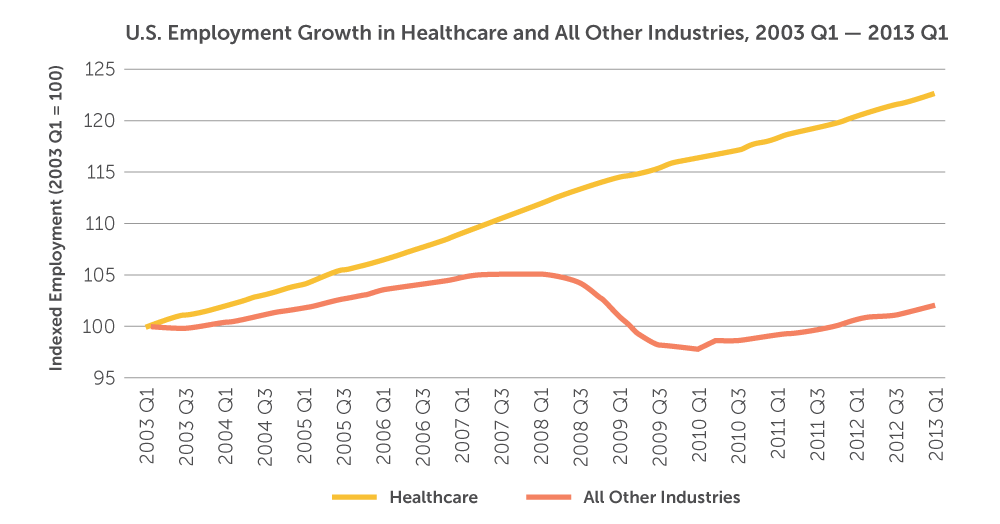

What these larger trends and industry examples suggest is not only do we need to continue the march towards volume, but we probably also have a failure of imagination in how to get us there. If Amazon eliminated the physical store, could a hospital eliminate registration clerks – or even the private room? Should the hospitals of tomorrow be designed to facilitate kiosk self check-in, autonomous driving beds and AI-powered chat bots for patient engagement and support? Productivity in many, if not all, industries has come through replacing people with technology. If a hospital could eliminate significant staffing though technology, what would that do to the overall cost of their physical footprint?

#3 – You can build a boutique inside your superstore

While it’s important to every health system’s mission to have a common level of clinical care for patients regardless of their income or even donor status – that doesn’t mean patient experiences can’t be segmented. For example, private pay wings and even bed towers are becoming more prevalent in the US. In addition, health systems could look at ways to support a bifurcated ER experience with separate parking and waiting areas but with common clinical staffing, for example. A health system could also consider separate room types and menus for a concierge floor. Private airport lounges and elite seating makes flying easier for a minority of flyers and annoys the rest of us, but the safety of the flights are not separated by status.

Colleges and universities are further along (for better or worse) with these macro-societal changes. Just like healthcare, these institutions have substantial public assistance but have largely adjusted to segment the experience based on tuition and donation ability. Health systems are not far behind. Even today, some health systems in the US can fund market game changes through 100 percent philanthropy. Recently Johns Hopkins raised $1B from two donors for a new bed tower. Healthcare leaders need to look at realities that have been demonstrated in retail, transportation and higher education and plot their own path. We may be uncomfortable with the future and what it means for the mission of many healthcare institutions– but that future is already here.

Learn more about the socio-economic changes impacting healthcare by reading our white paper.